Estimate depreciation on rental property

As for the residence itself the IRS requires. How to Calculate Depreciation by Month A real estate investor can.

Residential Rental Property Depreciation Calculation Depreciation Guru

7 steps to calculate depreciation on rental property.

. The IRS permits rental property owners to deduct a set percentage of the propertys cost basis from the taxes owed on the generated income over the useful life of the. The BMT Tax Depreciation Calculator helps you to estimate the likely depreciation deductions claimable for all types of property including residential commercial and manufacturing. So the basis of the property the amount that can be depreciated would be 99000.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. The annual depreciation comes off the top of your net operating income. We Can Calculate Rent Prices Based On Location and Apartment Size.

Landlords can deduct the cost of the building itself certain closing costs and any capital expenditures that improve it or extend its life. Ad Edit Sign Print Fill Online more fillable forms Subscribe Now. The first step is to determine how much you paid for the property.

When it comes to the rental property depreciation income limit owners will need to have a gross income limit of 100000 and are able to deduct up to 25000. This rental property calculator allows the user to enter all incomerevenue and expenses as well as information related to the purchase of the property. Ad We Can Help You Bring In Prospective Tenants Too With Our Free Rental Listings.

73725 total gain 24725 depreciation recapture 49000 x 15 seller capital gain tax rate 7350. Based on this information it. Total taxes owed for selling the rental property.

Lets say you bring in 12000 a year in rental income but have 4000 in operating expenses. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Rental Property Depreciation.

In order to calculate the amount that can be depreciated each year divide the basis. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses. Using the 275 useful life span guidelines outlined by the IRS you can calculate equal depreciation for each full year your rental property is actively renting units.

Determine the purchase price of the property. To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. The result is 126000.

To find out the basis of the rental just calculate 90 of 140000. If you wanted to calculate the amount that can be depreciated each year youd take the basis and.

How To Calculate Depreciation On A Rental Property

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

How To Calculate Depreciation On Rental Property

Rental Property Depreciation Rules Schedule Recapture

Depreciation For Rental Property How To Calculate

Rental Property Depreciation Rules Schedule Recapture

Macrs Depreciation Calculator With Formula Nerd Counter

How To Use Rental Property Depreciation To Your Advantage

Student Rental Property Owners Depreciation Bmt Insider

Straight Line Depreciation Calculator And Definition Retipster

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Converting A Residence To Rental Property

How To Calculate Depreciation On Investment Property Wb

Residential Rental Property Depreciation Calculation Depreciation Guru

How Much Is A Rental Property The Up Front Recurring Costs

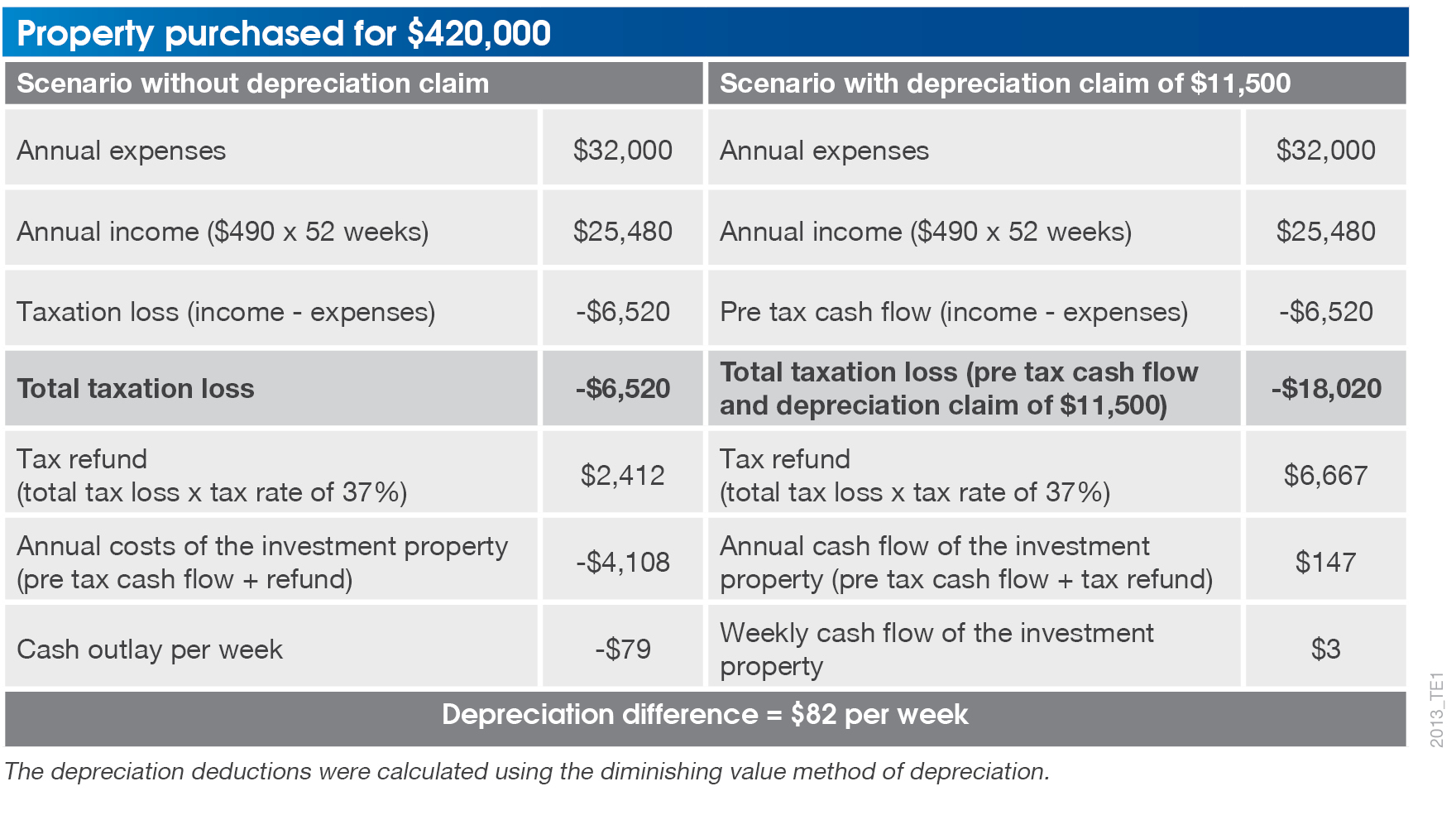

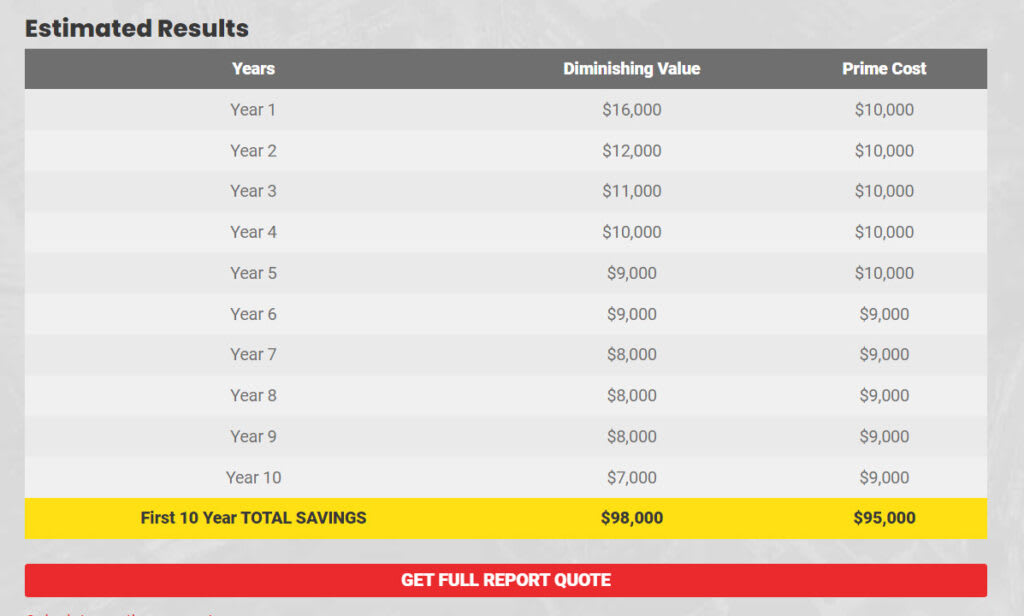

How Depreciation Claiming Boosts Property Cash Flow